A Different Way of Looking at Returns

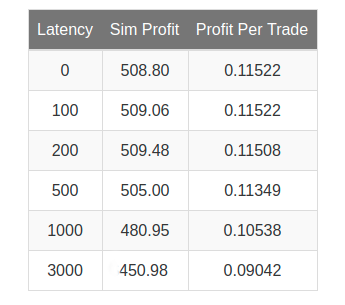

It would be nice if it were possible to trade a moving average cross. The problem with this is always that the data lags. It’s not possible to trade the current value of a moving average since it requires trading prices in the past. The advantage to doing so is that, due to the smoothing, forecasts are less noisy.

The good thing is than many moving averages are finite impulse response (FIR) filters, meaning they are the dot product...